Whenever you are experiencing problems with your PC | Laptop | Gaming Console | Cell Phone

Or Any Kind of Apple device, contact our company! We Will Diagnose & Fix everything you need!

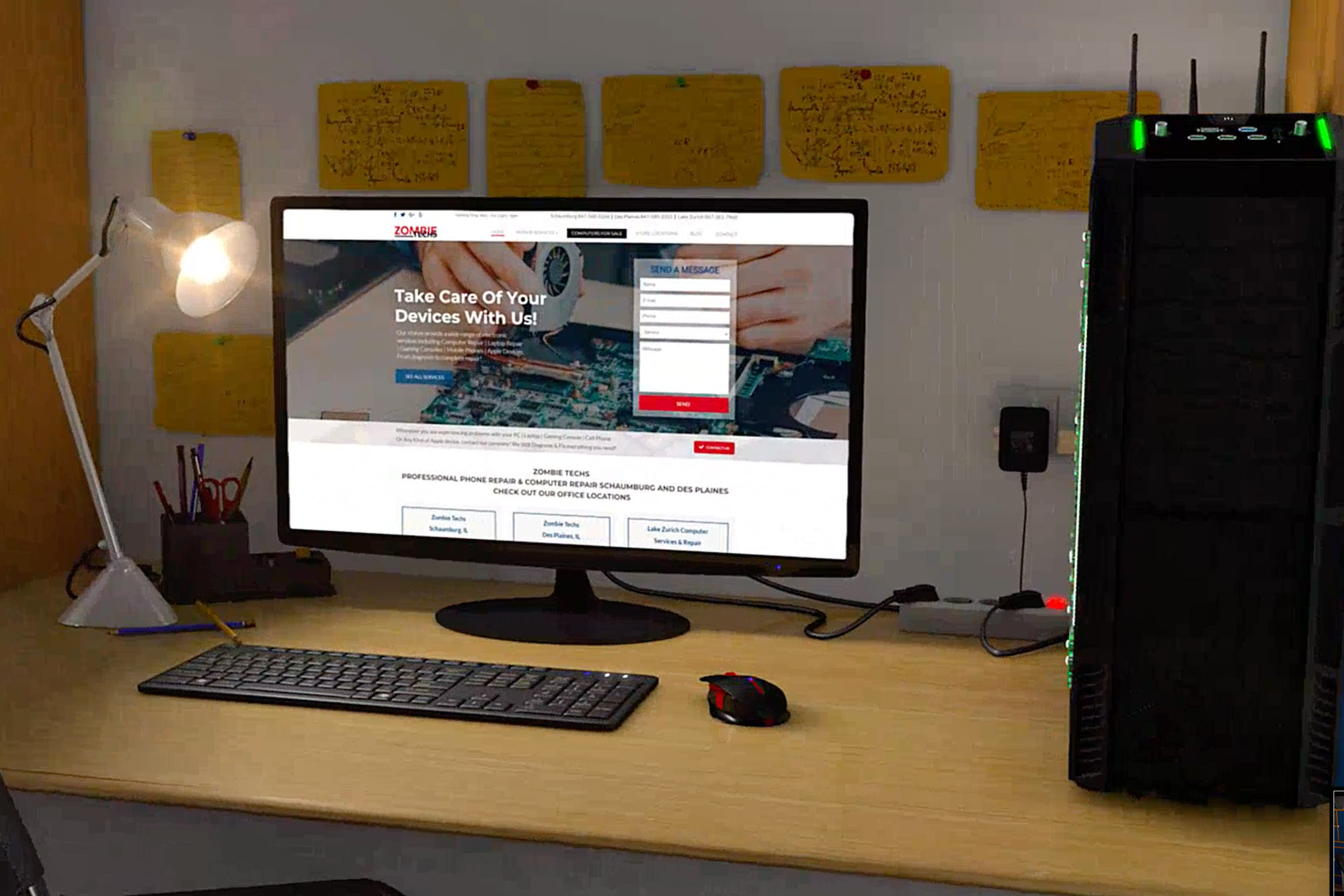

ZOMBIE TECHS

Professional Phone Repair & Computer Repair Schaumburg and Des Plaines

Check out our office locations

Zombie Techs

Schaumburg, IL

831 E Algonquin Rd.

Schaumburg, IL 60173

847-348-0264

Mon – Fri: 11am – 6pm

Zombie Techs

Des Plaines, IL

1635 E Oakton St.

Des Plaines, IL 60018

847-585-2355

Mon – Fri: 11am – 6pm

Lake Zurich Computer

Services & Repair

584 W State Rte 22

Lake Zurich, IL 60047

847-381-7960

Mon – Fri: 9am – 5pm

Sat: 9am – 2pm

ZOMBIE TECHS Computer Repair &

Laptop Repair Schaumburg

In business since 2010

Since we’ve opened in August of 2010, Zombie Techs has repaired over 15,000 computers, cell phones, tablets, and other gadgets for our customers in Schaumburg, Des Plaines, and the Northwest Suburbs. Our philosophy has always been to get the best talent in the store so we can approach those complicated and tricky repairs that big box stores overcharge for. Combining our skills with a fast drop-off and pickup environment, we strive to offer the highest quality and most affordable computer and cell phone repair services in Schaumburg, Des Plaines, and the Northwest Suburbs. Click here to read more about us.

IN ZOMBIE TECHS WE OFFER A WIDE RANGE OF SERVICES INCLUDING

iPhone | MacBook | iMac | Samsung | Dell | HP | Lenovo | Asus | MSI | Acer | Nintendo | Xbox | PlayStation | Custom Built PC

iPhone & Smartphone Repair

- iPad screen replacement.

- Power On/Off button replacement.

- LCD screen replacement.

- Speaker button replacement.

- Speaker replacement.

- Charging port repair.

- Parental Controls and Antivirus.

- Battery replacement.

- Microphone replacement.

- Camera replacement.

- Samsung smartphone repair.

- LG smartphone repair.

- Motorola Smartphone repair.

- Headphone jack replacement.

PC Computer Services

- Full PC and laptop repair service.

- Virus & Spyware Removal.

- Operating System Installation.

- Hard drive replacement.

- Data recovery services.

- Power Supply Replacement.

- DC Jack / Charging Port repair.

- LCD screen replacement.

- SMT circuit board repair.

- Motherboard replacement.

- Memory Upgrades.

- Hardware diagnostic testing.

- Surface Pro Devices.

- Surface Laptop.

iPad & Tablet Repair

- iPad screen replacement.

- Power On/Off button replacement.

- LCD screen replacement.

- Speaker button replacement.

- Speaker replacement.

- DC Jack / Charging port replacement.

- Parental Controls and Antivirus.

- Battery replacement.

- Microphone replacement.

- Camera replacement.

- Headphone jack replacement.

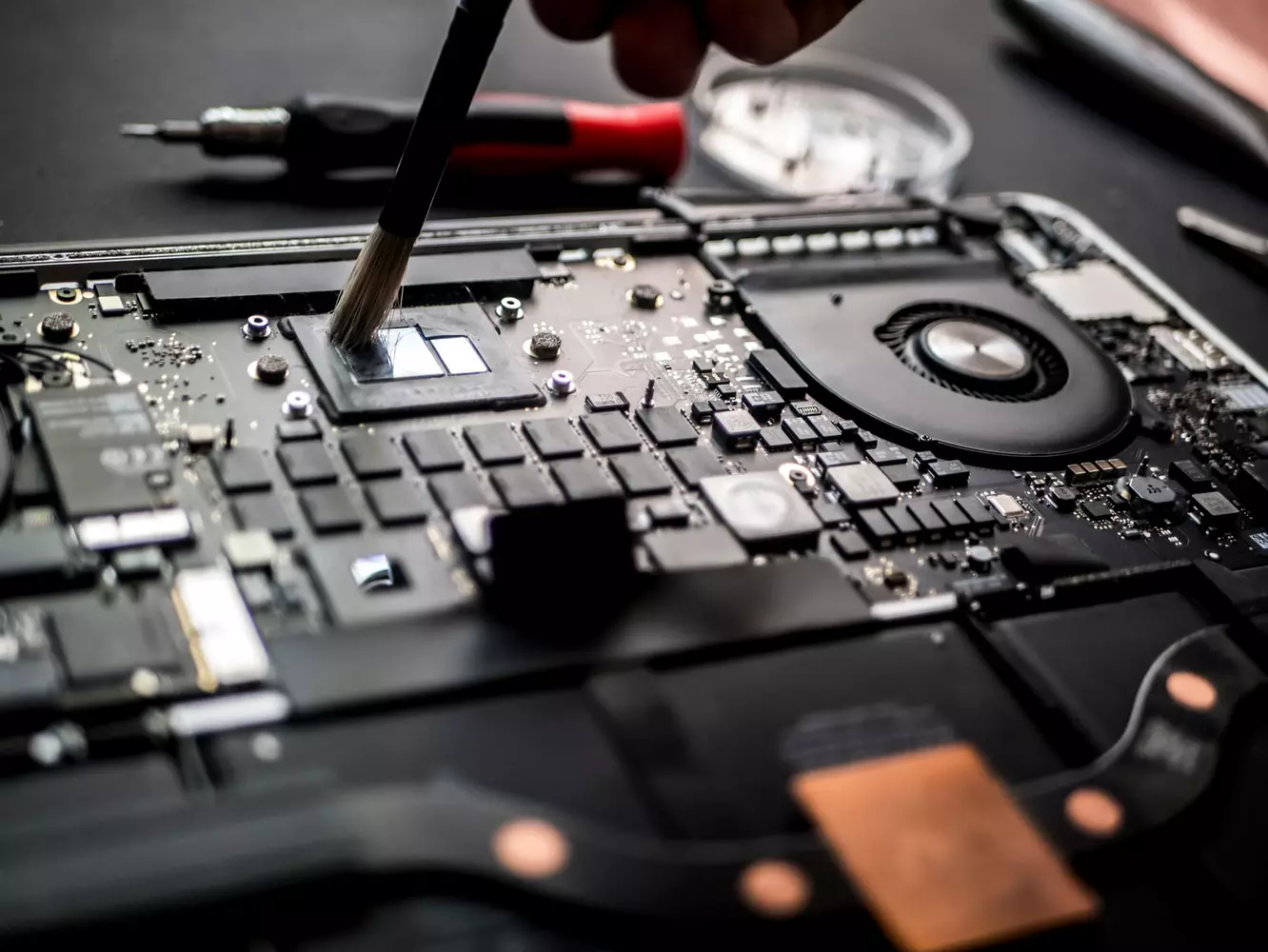

Macbook & Apple Product Repair

- Macbook screen replacement.

- Adware and spyware removal.

- Operating System Installation.

- Hard drive replacement.

- Data recovery services.

- Power Supply Replacement.

- DC Jack / Charging port repair.

- SMT circuit board repair.

- Logic board replacement.

- Memory upgrades.

- Hardware diagnostic testing.

Common Repair Types

- LCD screen replacement

- Charging / power-on repairs

- circuitry and component level repairs

- hardware diagnostic testing

- virus removals and operating system repairs

- formatting and new operating system installations

- initial data recovery services

Smart Phone Repairs

- LCD screen replacement

- cracked glass replacment

- charging port repair

- volume button repair

- battery replacement

- storage upgrades

- circuitry and component level repairs

- flashing

- unlocks

Why Should You Choose ZombieTech For Your

Apple Devices & Computer Repairs Schaumburg?

Issues That Require Professional Computer Repair Schaumburg & Des Plaines Services

Let Us Help You with Any Type of Computer Repair or Laptop Repair Needs!

Testimonials

Andrew F.

Lake in the Hills, IL

Kim S.

South Barrington, IL

Thomas B.

Schaumburg, IL

Your Computer Gets Slow

Your Computer Gets Slow Virus

Virus Accessories Not Working

Accessories Not Working No Space in Computer

No Space in Computer